NY Bagel Scammer Joe Smith to Get LESS Than Five Years for Massive Franchise Fraud

NY Bagel scam victims, some of whom lost homes, marriages and as much as half a million dollars, are feeling victimized once again by a justice system that failed to protect them, kept the details of the closed-door proceedings from them, then failed to hold their financial predators fully accountable. by Sean Kelly

(UnhappyFranchisee.Com) Despite the fact that I have been exposing the NY Bagel scam of Dennis Mason and Joseph Smith since 2013, was instrumental in initiating four successful state and federal investigations, no one thought to share this press release (below) issued by the DOJ nearly 2 months ago.

Judging from the very basic questions I’m hearing from the victims, it didn’t occur to anyone to share this information with them, either.

Judging from the very basic questions I’m hearing from the victims, it didn’t occur to anyone to share this information with them, either.

And though it should be a major conviction & a national story, the tepid press release was picked up by a single news outlet (Newsweek).

And like the entire prosecution & court process, the announcement seems to have been conducted with minimal public engagement and, for some reason, a lack of vigor.

According to the press release, the IRS is the main victim here – as Smith and Mason had the gall to deprive the government their cut of the ill-gotten gains(!). The fraud victim’s plight seems to be a non-issue.

Joe Smith’s 9 counts have been reduced to 2 lesser charges – with NO charges for fraud

Joe Smith’s preceding indictment on 6/9/21 stated: “Between 2008 and 2018, Dennis Mason sold more than 160 New York Bagel franchises. These prospective franchisees paid more than $2.1 million in franchise fees to New York Bagel.”

It appears that the 9 original counts in the 6/9/21 indictment against Joseph Smith have been dropped, which included:

- Conspiracy (1 count),

- Wire Fraud (2 counts),

- Tax Evasion (3 counts), and

- Failure to File Tax Returns (3 counts)

The more-recent Waiver of Indictment document dated 2/11/22 states that Joseph Smith decided to opt-out of a trial, and “waives in open court prosecution by indictment and consents that the proceeding may be made by information rather than indictment.”

Nice that Joe Smith was granted the right to make that decision without input (or knowledge) of the victims.

The Waiver of Indictment indicates that the 9 counts against Joe Smith have been replaced by only two counts of lesser charges:

- 18:371 – Conspiracy to Commit Wire Fraud (1ss)

- 26:7201 – Tax Evasion (2ss)

There is no mention of the devastation and high costs to victims who lost their homes, marriages, retirement funds and as much as $500,000 to a million dollars because of this blatant & public Craig’s List-based scam.

Smith Faces a “Maximum of Five Years in Prison” on both Charges. Mason’s Plea Deal is Still Sealed.

According to the 2-month-old release, Joe Smith faces a maximum penalty of five years in prison on both the tax evasion and conspiracy charges, and maybe a period of supervised release, restitution and monetary penalties.

Mason previously pleaded guilty to wire fraud and conspiracy to commit wire fraud on June 25, 2020. He has a sentencing hearing next Wednesday (unless it’s rescheduled like so many before).

Dennis Mason’s Plea Deal is Still Sealed. He’s Been Free Since July, 2020. He’s Required to “Maintain Current Employment”: Selling Franchises

Dennis Mason has been free on his own recognizance since being granted bail July 30, 2020. One of the few conditions of his bail order is that he “maintain present employment.” Mason’s only employment for decades appears to be making fraudulent claims and selling franchises that will fail or never open. The bail order specifically allows – no REQUIRES – the serial scammer to continue to sell franchises.

Dennis Mason has been free on his own recognizance since July 30, 2020… The bail order not only allows – it REQUIRES – the serial scammer to continue to sell franchises.

Both NY Bagel Franchise Sales Sites & Attack Blogs Are Still Live & Recruiting Victims

Joe Smith & Dennis Mason have been free to go about their business and harvest leads from the dozens of NY Bagel Cafe, NYC Bagel & Sandwich Shop and Davidovich NYC Bagel franchise sites and social media pages that they’ve never been required to take down.

Also still live are more than 40 vicious & defamatory websites, videos and social media posts that attack Sean Kelly and his family members in an unsuccessful effort to force him to stop warning potential victims and informing law enforcement.

If You Find This Outcome Unacceptable, Please Contact Sean Kelly at UnhappyFranchisee[at]Gmail[Dot]Com

Here’s the Justice Department’s press release of February 11, 2022:

FOR IMMEDIATE RELEASE

Friday, February 11, 2022

Bagel Company Owner Pleads Guilty to Tax Evasion and Wire Fraud Conspiracy

Deceived Franchisees into Paying More Than $1.3 Million

A New York man pleaded guilty today to tax evasion and a wire fraud conspiracy.

According to court documents and statements made in court, Joseph Smith, of Fishkill, owned and operated New York Bagel, a business that operated in Pennsylvania and other states. Smith and Dennis Mason conspired to defraud individuals who sought to open new franchises of New York Bagel. Smith and Mason induced the prospective franchisees to open up New York Bagel stores by understating the startup costs, overstating the number of franchises that were up and running, and exaggerating the financial success of existing franchises. Smith and Mason charged prospective franchisees fees ranging between $7,500 and $44,500 to gain rights to open stores. When prospective franchisees learned of the misrepresentations, Smith refused to refund these fees.

For the years 2014 through 2016, Smith deposited more than $1.3 million in franchise fees into New York Bagel bank accounts he controlled. Smith spent these funds on personal items wholly unrelated to New York Bagel including rent for his personal home, recreational travel, car payments for personal vehicles and everyday living expenses. Smith did not timely file corporate or individual income taxes for these three years, or pay the taxes owed to the IRS, even though he was required by law to do so.

Mason previously pleaded guilty to wire fraud and conspiracy to commit wire fraud on June 25, 2020.

Smith is scheduled to be sentenced on May 24. He faces a maximum penalty of five years in prison on both the tax evasion and conspiracy charges, as well as a period of supervised release, restitution and monetary penalties. A federal district court judge will determine any sentence after considering the U.S. Sentencing Guidelines and other statutory factors.

Acting Deputy Assistant Attorney General Stuart M. Goldberg of the Justice Department’s Tax Division and U.S. Attorney Jennifer Arbittier Williams for the Eastern District of Pennsylvania made the announcement.

IRS-Criminal Investigation is investigating the case.

Trial Attorney Eric B. Powers of the Justice Department’s Tax Division and Assistant U.S. Attorney David Ignall of the U.S. Attorney’s Office are prosecuting the case.

WHAT DO YOU THINK? SHARE A COMMENT BELOW!

Further Reading:

NY Bagel Franchise Scam website

NY Bagel Scam Video series

NY BAGEL CAFÉ Guilty of Fraud, Fined $764,899.33

DENNIS MASON Franchise Complaints

Joe Smith, Dennis Mason & NY Bagel Café Franchise Exposed: 10 Things You Should Know

DENNIS MASON Franchise Lawsuits, Controversies, Aliases & Warning

NY BAGEL CAFÉ Franchise Fraud Investigation by MD Attorney General

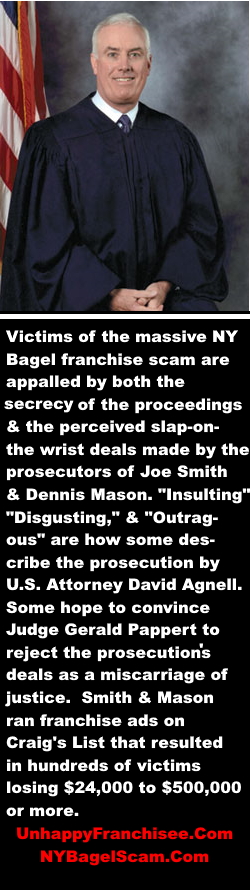

TAGS: NY Bagel Scam, Bagel Franchise Scam, NYC Bagel franchise, Joe Smith scam, Dennis Mason Franchise scam, Joseph Smith Newburgh NY, Bagel scam Trial, US Attorney David Ignall, US Attorney Eric Powers, Judge Gerald Pappert, Judge Jerry Pappert