“Semi-Absentee Investor Franchise” is a Scam – Phoenix Franchise Brands Franchisees

It may be the newest chapter in the Franchise Fraudster’s Playbook: Tell people they can own a franchise without quitting their jobs. It only requires 2 hours per month because the franchisor will run the business for them. Own a franchise remotely – from across the country – and collect passive income from a booming business. That’s a franchise model offered by Greg Longe and Phoenix Franchise Brands, their sales force Rhino7, and an army of franchise sales brokers eager to cash in on the $35,000 referral bounty. According to franchisees, there’s only one problem: It’s all a lie. By Sean Kelly

(UnhappyFranchisee.Com) According to franchisees of Phoenix Franchise Brands, which includes such franchise concepts as Fetch! Pet Care, Furry Land Mobile Pet Grooming, Spray Foam Genie, Door Renew, MedSpa810, Steel Coated Floors and Worried Bird Window Washing, the “Semi-Absentee Franchise” model promoted by the company, its Rhino7 sales force and its army of commission-driven brokers is a lie.

A scam.

A pyramid scheme designed to drain its trusting victims of every last dollar.

Here’s what what franchise victims told the Federal Trade Commission (FTC) during its recent call for open comments on franchising.

“…They are intentionally defrauding investors”

The primary appeal of this franchise was its absentee-owner program, a model that attracted about 90% of the 80+ Spray Foam Genie franchisees.

The program promised that for an additional monthly fee, all day-to-day operations would be managed by the company, enabling franchisees like myself to own territories from afar with minimal involvement.

I was enticed by this prospect and invested $350,000 in what was marketed as a premium territory over 1,250 miles away.

The assurances given to me included that home improvement professionals would oversee my business operations, my involvement would be limited to around two hours per month, and that the market could sustain five teams.

To date, I have poured over $700,000 of my savings and $300,000 in equipment financing into this venture.

Yet, despite these substantial investments, my sole operational team remains unprofitable…

Of the approximately 80 franchisees, only four report only four report profitability…

Phoenix’s practices bear a striking resemblance to a pyramid scheme, and I believe they are intentionally defrauding franchise investors.

Aaron Bakken, Spray Foam Genie Franchisee

“The system is a scam…”

“…I was misled to believe it was a flourishing system and franchisees were successful and making money.

But that was a lie.

The system is a scam and nearly impossible for the franchisees to make money.

The only one making money is the franchisor who gets huge fees from us franchisees.

We were sold into the “Investor Model” (i.e. managed services model) with the promise that we would only need to spend 2 hours a month for two monthly meetings with corporate.

They ensured us that they would literally run the entire business for us (i.e. do all of the marketing, hire all employees, manage employees, and get us to profitability much quicker especially if we bought two locations)…

We used our retirement accounts in a ROBS (rollover as business startup) to fund the business and those funds are almost completely depleted.

This franchise was supposed to allow my wife to retire in a reasonable timeframe so she could care for our newly adopted daughter.

Instead, because of this near total loss, her retirement is going to be extended at least another decade and we are basically having to start those retirement savings over from scratch.

… [We] will have to shutter the business by summer of 2025.

Fetch! is not a viable franchise under this ridiculously high fee structure.

If I had known what I know now, I never would have bought a franchise…

Joseph & Hannah Duce, Fetch Pet Care franchisees, San Antonio, TX

“This venture has drastically impacted my life, forcing me to use my 401k without the ability to recover…”

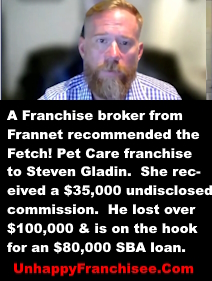

To date, I have invested over $100,000 to Fetch! Including the initial franchise fee and royalties for the last 3 years.

This venture has drastically impacted my life, forcing me to use my 401k without the ability to recover those funds.

I have three young children, and I am now taking on consulting work to provide some income for my family…”

Corey & Sandy Ellis , Fetch! Pet Care franchisees, Monrovia-West Covina, CA

“We were told would [there] be passive income… our margins are not big enough to pay the royalty fees…”

I purchased my franchise(s) on 20 August 2020

We utilized a Franchise Broker, Meg Schmitt through FranChoice… We spent the better part of a year talking to Meg.

Because of what we were told and shown in the FDD, we believed in the franchise model—it offered a support system and a proven business structure that we were told would be passive income

Our initial fee was $59,500.

We took out a loan for an $80,000 SBA loan to pay the initial fee and have the remainder as working capital.

We have taken losses every year.Our sales have grown every year, but our margins are not big enough to pay the royalty fees, operation fees and make a profit.

Steven Gladin, Fetch! Pet Care franchisee

“By our third anniversary, we… couldn’t afford the increased royalty minimum payments…”

Our franchise broker recommended Fetch! Pet Care after thorough research…

We felt it was a good opportunity for passive income in the future and to help set us up for retirement…

By our third anniversary, we were barely breaking even and couldn’t afford the increased royalty minimum payments without significant cash infusion.

Heather had to work another job to support the business while also working full-time in it.

The SMC, sold as a comprehensive customer service center, was poorly managed, leading to numerous errors and customer dissatisfaction.

Other franchisees reported similar issues, indicating a pattern of failed support and forced exits benefiting the corporate office…

David Williams, Fetch! Pet Care franchisee with sister, Heather Connelly

“It was the biggest financial mistake of my life… It feels hopeless right now”

My coach from The Entrepreneur’s Source introduced me to Tom Moore of Rhino7

[They claimed] The Managed Services model did not require much if any involvement from the owner.

We went live in August 2023…

Because the business exhausted my finances and the stress of this endeavor caused significant mental duress, I signed a termination agreement and release agreement on May 31, 2024.

What began as an endeavor for the love of pets and to serve our local communities ended in a complete and absolute nightmare.

I never saw any results from these marketing services and they never provided detailed explanations of how these funds were allocated.

My operation did not even survive a year and in the short time we were in business we did not even come close to achieving even $10K in gross revenue.

Now I find myself in significant debt – $175K

It feels hopeless right now because I do not see a light at the end of the tunnel and I have no idea when I will be able to repay this exorbitant debt.

It was the biggest financial risk I have ever taken and also the biggest financial mistake of my life.

Anonymous Fetch! franchisee

“As a mother of three young children… This situation is heartbreaking.”

I am a Fetch Pet Care owner based in Southern California and purchased my location four years ago.

The more successful I become, the more I pay to the franchise, which positions me further away from achieving my goal of passive income.

This situation is heartbreaking. As a mother of three young children, I often have to take on consulting jobs to contribute to my household income.

Despite paying 28% in royalties weekly, I have received little to no support or value in return.

Anonymous Fetch! Pet Care Franchisee

“Our daughter invested nearly $200k… [and had] to sell her home when things did NOT turn around.”

The Phoenix Brands’ “Fully Managed Contract” was marketed as a “hands-off” investment, where the franchisor would market, bring in customers, hire sitters, and handle operations, leaving franchisees to simply collect income.

…the point of this contract is you pay a high fee, and corporate does nearly all the work…

In 2021, our daughter invested in a Fetch! Pet Care franchise.

Sadly, these promises have proven false.

Our daughter invested nearly $200k and my husband and I invested $20k out of our retirement savings…only to see her have to sell her home when things did NOT turn around.

Investors have poured thousands of dollars into purchasing vehicles, retrofitting them for dog grooming, buying supplies, and more, only to find themselves without any revenue or customers six months later.

Some closing their doors and going broke before even getting a single paying client.

Anonymous Fetch! Pet Care franchisee

“[Franchisor was] not abiding by the Terms of the Agreement”

…we were sold on the idea that the franchisor would operate the business on our behalf through a managed services agreement.

After two months of operations, we determined that they were not upholding their part of the agreement…

In response, we joined multiple conference calls to address our concerns and ultimately were released from the managed services agreement that we had entered into.

]They insisted] this was not an admission of wrong doing, but also did not address the concern that the franchisor was not abiding by the terms of the agreement that they had signed with us and presumably with other locations.

Furry Land franchisee Michael Wankier

“They are robbing families of their savings…”

They are deceiving many people by selling them the managed service program that does nothing but take money out of your account every week.

…I was told by Greg Longe That I was buying into an investor model and paying a management fee for them to run the company.

[He] had stated that they knew how to get these businesses profitable very quickly.

In the 18 months that I was open, I pretty much had to do everything without hardly any help from them.

…I put in an additional $185,000 and never had one month profitable.

I was totally deceived by Greg Longe into purchasing it Furry Land franchise for West Palm Beach Florida.

Lost my entire savings and had to take out loans.

I have talked to many other franchisees that are under the managed services model and not one of them has made a profit…

I am asking That Phoenix franchise group Greg and Maria Long be investigated on the practices and deceptions that they are robbing families of their savings.

Furry Land franchisee Christopher Galea, Branch, MI but was sold a franchise for West Palm Beach, FL

“…a Pyramid or Ponzi scheme is at hand.”

“My husband and I have been the victim of what we consider a fraudulent or misrepresented franchise model owned by Phoenix Franchise Brands and Greg and Maria Longe out of Michigan.

We own Furry Land, one of their four brands… because they advertised a “Investor Only Hands-Off model” that is using managed services to run your location…

Not only is the model NOT handsoff… We are in the thick of it day in and day out and have to be in order to keep the business from sinking.

“We also do not see the managed services model as staffed enough to really run our businesses.

… Most of [us] think a Pyramid or Ponzi scheme is at hand.

Anonymous Furry Land Franchisee

Also read:

Fetch! INDEX: FETCH! Pet Care Franchise Complaints (Index) October 23, 2024

Phoenix Franchise Brands, Greg Longe Franchise Investigation (VIDEO)

Kevin Longe, Greg Longe, Rhino7 Sued for Fraud, Embezzlement November 13, 2024

Invitation: Please Share Your Opinion of Experience (Anonymity Assured)

Are you familiar with the “Semi Absentee Investor Franchise” model being pushed by franchise brokers?

Are you familiar with Greg Longe? Phoenix Franchise Brands? Rhino7 franchise sales? IFPG, Franserve, Franchoice or other Broker Groups?

Please leave a comment below or email us, in confidence, at UnhappyFranchisee[at]Gmail[dot]com.

Franchisors: The franchisor, its employees and agents are invited to submit correction, clarifications, rebuttals or other opinions for immediate consideration.

UnhappyFranchisee.com is not associated with this or other franchise company or seller.

Tags: Semi Absentee franchise, Investor Franchise, Franchise scams, Phoenix Franchise Brands, Greg Longe, Rhino7, franchise broker fraud, IFPG, International Franchise Professionals Group, Franserve, Franchoice, The Business alliance, the Entrepreneur’s Source, FBA

Any absentee business is a scam.

No such thing.

A franchisor to make such a claim is a huge red flag to begin with.

Yes, these “brokerage” “consultants”, call them what you want have no clue what it takes to run the majority of these businesses being offered.

The majority of those folks are victims themselves buying into the whole being a franchise broker business as being a passive income.

Just a major shit show no matter where you look.

Franchising has changed tremendously. Not the warm fuzzy family feeling slick franchisors use to portray. Once equity firms are done merging, selling off and even bankrupting the majority of thesr franchisors that were purchased, the game will be all but over for the true mom and pop entreprenuer.

Very sad. Our country was founded on hard work, today its become a taboo.

The business model of PBF is to keep selling and transfer failing ones to new ownership to avoid having to list failed locations in the FDD.

Greg Longe actually told someone that I know, this is his business model.

With the SFG franchise, they actually make the new owner, who is taking over the failed location, pay the full “territory fee” that the first owner paid for, telling the new owner they are refunding the first owner that fee, which they don’t.

The inaccurate Item 19, having their Franchise Advisory Council sit on calls with prospective franchisees telling them how fantastic the franchise is while they are all so far in debt and directing prospective franchisees to the more successful franchisees to speak to for discovery calls (illegal) is the reason they keep on selling.