LIBERTY TAX Leaked Email Exposes Sleazy Sales Tactics

Liberty Tax former superstar trainer Annie Fuller reveals sales tactics using fear, greed, shame and guilt on customers to boost revenue in an internal email leaked to UnhappyFranchisee.com.

Annie Fuller was a Liberty Tax Services franchisee superstar.

UnhappyFranchisee.com has received an internal memo that is also an exhibit in an active Liberty Tax lawsuit. In the email, Fuller outlines the sales process she has used to train franchisees and their tax preparers nationwide.

The questionable sales process promoted by Fuller is based on manipulating the customer’s emotions (Fear, Greed, Shame, Guilt) to get them to accept a seemingly inflated tax preparation fee.

The first, and most useful emotion, according to Fuller is FEAR.

Step One (Fear): Give the customer a “heartattack”

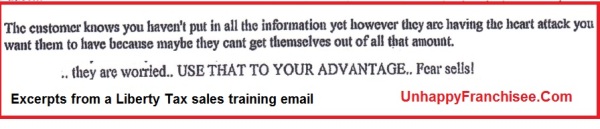

“Fear sells,” writes Fuller. She instructs the preparers to scare Liberty Tax customers by showing their tax liabilities before any deductions, and emphasize the size of the amount due to instill panic.

Writes Fuller:

Start by putting in ONLY and ALL their income…

State clearly “based on your income you owe the IRS $_____”

Use the word THOUSAND if it applies not 15 hundred. 2 THOUSAND 5 hundred dollars. 3 THOUSAND dollars!

If they owe very little or have a refund… you owe the IRS some money right now or you are ONLY getting back $___ dollars.

If Step One is done correctly, according to the Liberty Tax trainer, “they are having the heart attack you want them to have because maybe they cant get themselves out of all that amount.

“they are worried…” writes Fuller. “USE THAT TO YOUR ADVANTAGE… Fear sells!

Step Two (Relief): Be the hero with magic Liberty Tax forms

Once the customer is sufficiently scared (or depressed), the preparer should announce that he/she will now save the day.

Fuller instructs preparers to say “Ok now its time for me to go to WORK (emphasise this word, You’re in good hands, we are going to work together to get this amount lower/refund higher. We [Liberty Tax) will be like the safety net between you and the IRS…”

Fuller tells Liberty Tax franchisees and preparers to begin to simultaneously lower the customer’s tax burden and raise/justify the growing preparation fee in a series of stages.

Liberty Tax preparers are never to name the additional forms they add to the return, just to call them by the amount of Liberty’s upcharge for including the form.

Writes Fuller:

“ok we are only going to ADD (emphasis this word) a $70 form and lets see how this helps you, as you know we ONLY charge for forms we use on YOUR (emphasise this word) return, so we’ll see how well this helps you…

Put in basic sch A stuff but do not educate client on name of form just call it a $70 form…

“Ok based on your income you OWED the IRS $_____ so now you only owe the IRS $_____” or are getting back $_____

at any point if they aren’t actually getting a refund state this even more emphatically “I was able to get you $_____ MORE! ISNT THAT GREAT?” (nod head while doing this to get them to nod back)

“Now lets see if we can do more, I’m going to ADD another $45 form, again we only charge for the forms we use for YOUR return so lets get going.”

Add in a 2106 but again do NOT educate client on what form…

If they have other deductions like vehicle use the same method… we’re going to add a $25 form, let’s see where we’re at now… etc. etc.

Fuller emphasizes the importance of not educating the client as to the names of the forms, and to refer to them by their upcharge value to desensitize the customer before presenting the whopping prep fee at the end.

Former Liberty Tax superstar trainer instructed preparers to use her techniques to boost their tax preparation fees so high ($400 – $650) that she has developed more steps to help preparers actually tell the customers the final fee with a straight face.

Check back for more steps to come…

ARE YOU FAMILIAR WITH LIBERTY TAX SALES PRACTICES?

SHARE A COMMENT BELOW.

Also read:

LIBERTY TAX SERVICE Franchise Complaints

I was not provided with a franchise disclosure document (FDD) within the required 14 calendar days stipulated in the federal franchise law, which does not contemplate any exceptions to this requirement. From the franchisor’s corporate office arrived an envelope with a FDD signature page, a hand written note asking me to sign and back date the document, as well as a return envelope. Thankfully, I stood to my instinct and never signed and returned what they’d sent me. A complaint with the FTC has been initiated. According to the law the Federal Trade Commission (FTC) can not only fine a franchisor for violating this law, but it can also demand that any franchise fees paid by the franchisee, funds invested into the franchise business, plus multiple damages be refunded to the affected. Has anybody been a victim of this type of franchisor’s unfair and deceptive business practice?

Annie Fuller is a known crook. I never ever interacted with her and I never heard anyone from Liberty advocating the tactics she used. Ive been through Liberty’s “Closing the Sale” training many times, and it advocates nothing at all like this. It focuses on creating value by pointing out Liberty’s competitive advantages over its competitors. If focuses on doing things for the customer our competitors won’t do, like offer them a snack and a soda when they come in to the office. Never charge them for advice. Never charge them for a replacement copy of their return. Drive checks to their house if they are in a bind. All sorts of things that are customer centered, never this kind of nonsense.

I also do not believe the story about Liberty not following the letter of the franchising regulations. They are meticulous in that regard. Hewitt has been successfully franchising for a very long time, so this is one area they have down pat. Folks looking at a Liberty franchise should watch for themselves and see how this is handled. It’s simply not credible to believe they are sloppy in the one area they’ve been so successful in. Violating the law? Nope, never seen it in all my years as a franchisee.

Hi Bubba,

Welcome to the board. Glad you are one of the few successful zees to comment on this board, we -should I say Liberty- needs more of you. Has your Area Developer asked you to borrow money when you are creating -padding- your FAC? If NO, you are a lucky Bubba!

Bubba,

You are wrong. I’m in season two as a returning Tax Preparer with Liberty. I currently work at 3 offices. The office that taught me tax school, basically taught us Tax Law (the exception to the rule), the second office I worked at in season 1 (last year 2016), on the first day of P&P we were taught The Fuller Method. I completely disagree with it. I educated my clients on each and every form I used to help them, and then, explaining why the form is necessary, and how not using that form impacts their return. At the end I explained the fee for each form. Moreover, as a means to mitigate the blow of how high the fees are, I went the additional step of educating my clients about how to fill out their W4s so as to not take so many exemptions. I know my low income clients, and my upper middle class clients just like being treated with respect, assuming their smart, and also acknowledging that the level of complexity built in to filing taxes and using worksheets means no matter how much secrets I reveal, they won’t trust themselves to do it correctly, either for lack of time, or because they it doesn’t make any sense to them when someone isn’t there to help. My only walk out clients in my first year were the ones I purposefully wanted to leave-the type of clients shady Zees and Preparers would file bogus returns for just to game the refund. They don’t appreciate being educated as to how that suddenly remembered side hustle as House Hold Income gardners and hair stylists or self employed consultants is actually going to result in them owing when not throwing that crap on there simply meant they owed nothing. This is why I educate, so I can legitimately build value and scare the shit out of the fraudsters while impressing the law abiding citizens.

Good on you Roger, you sound like a great (honest) preparer. The reality is Liberty’s model is centered on the low-income, EIC, rapid return filer. They know the game, and there are preparers everywhere who cater to these people in order to get them the ‘maximum’ return.

Most higher income filers aren’t coming to a Liberty office because some costumed-clown waved them in. They prefer mom and pop, CPA’s and HRB.

Truth be told, I live in Los Angeles county. The Liberties that got shut down around me were the ones where there is a heavy mix of middle class filers (up to low $100K) and working class filers (your traditional EIC types). The second office I worked at last year, was located in a zip code that doesn’t support the traditional Liberty Model (we were wearing slacks and button down collard shirts). Teachers, Administrators, ITs, Skilled Laborers, Uber Drivers, Military, Semi-Retired, W-2 plus start up Independet Contractor Businesses. The first office was located in a more traditional liberty neighborhood but did things the right way and taught us tax school from the perspective of how to beat an IRS Audit, and satisfy due diligence requirements, basically the level of knowledge imparted into us was beyond the 60 hour class in CA, if you followed one of those online tax schools, we got more advanced training, bordering into silver and gold level for Liberty.

I’m currently teaching a rapid tax course that has mostly Financial and Accounting professionals, one of the students was a graduate of a liberty tax school in a poor area, aced all the work but they never entered in his hours with CTEC, he came to my class, and chose to stay when he realized he was trained on just handeling a client that had 1 W-2 and nothing else. His mind was blown, and his reaction, got everyone to fall in line with my teaching them how I was taught.

Also, after the tax school training I received, I found myself amending tax returns from previous years that were filed by CPAs because they didn’t understand filing status rules, or weren’t aware of how to justify/take advantage of certain deductions and credits. I also found that the upper income people I serviced were looking for an excuse not to stick with their CPA or HRB even if they quoted a cheaper price than we did.